Having a vacation home in Italy is not quite the same as buying a house in Italy to move there. But choosing to buy a vacation home in Italy while living elsewhere is a choice that, on the one hand, allows you to spend your holidays in Italy and, on the other hand, make a real estate investment while preparing for your retirement in Italy. Let’s see together what the differences are between having a primary residence in Italy and having a vacation home in Italy.

- Vacation homes in Italy

- Real estate purchase in Italy: taxation

- How much does it cost to buy a vacation home in Italy?

- Taxes for a house in Italy

- Houses for 1 euro in Italy

- Houses for sale in Italy

- How to finance a property abroad?

Vacation homes in Italy

If you’re one of those people who have family in Italy or spend all their vacations in Italy, then buying a second home in Italy could be an option to consider. This could allow you to travel more often at a lower cost while renting out your property for part of the year to make your purchase profitable!

The main difference between buying a house in Italy with the intention of establishing your primary residence there and the project of buying a second home in Italy is primarily a matter of taxation in Italy.

Real estate purchase in Italy: taxation

From the initial stages, the final destination of the property will determine the amount of registration taxes with the land registry. In the case of a vacation home in Italy, this amounts to 9% of the cadastral value of the property. However, one must not forget the rest of the taxes listed in the article Buying a house in Italy.

How much does it cost to buy a vacation home in Italy?

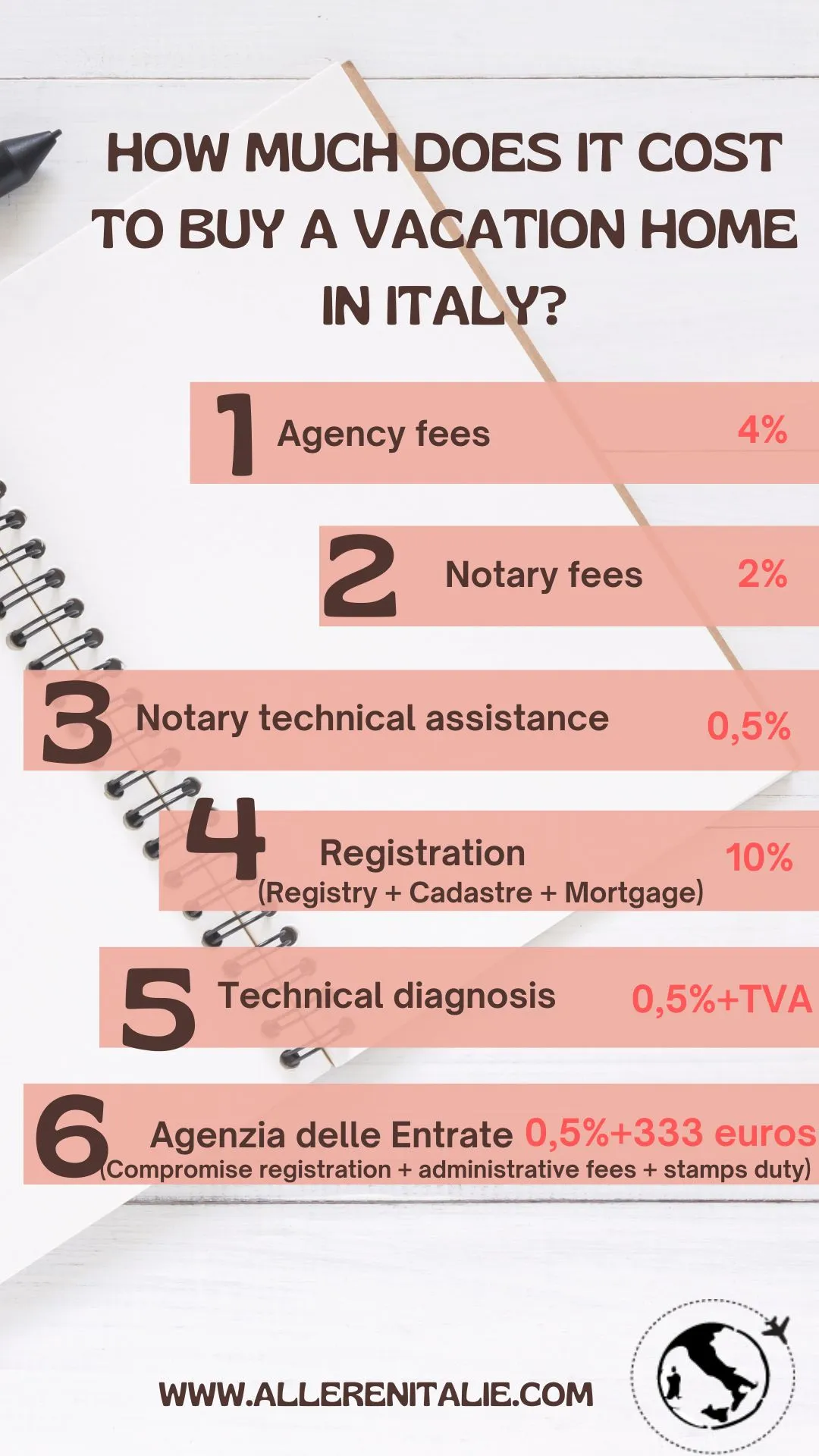

in order to have a more precise idea of the final price of a house in Italy, let’s look at all the charges to be paid:

- For notary and real estate agency fees, this is an average. It may happen that you are asked for a higher or lower amount, as in Italy agency fees are shared between the buyer and the seller and are not included in the displayed sale price, but this can already give you an idea.

- Regarding technical assistance to the notary, these are the fees charged for drafting the deed.

- The technical diagnosis is carried out at the buyer’s request and is therefore not mandatory.

- The various registration fees in different registries cost approximately 10% of the cadastral value of the property (usually it is indicated as 9% but I round it to 10% to cover all administrative fees that may occur).

- Finally, to register the preliminary contract at the Agenzia delle Entrate, you have to count 0.5% + 168 euros + 45 euros for stamps + 120 euros for administrative fees.

Ultimately, if we take the example of a house priced at 150,000 euros, then the final price of the house would be approximately 175,900 euros, which is 17.2% more than the initial price.

Taxes for a house in Italy

Houses for 1 euro in Italy

The 1 euro houses initiative has been tremendously successful in recent years and has garnered significant attention. The primary goal of this initiative, which originated in Sicily, was to repopulate villages, restore abandoned buildings, and allow property owners to dispose of properties they do not inhabit while still paying taxes on them.

Currently, most available properties are located in Sicily, but the updated list can be found on casea1euro.it.

On this website, you can find the list of municipalities participating in this initiative, although not all consistently offer properties.

We also recommend reading our dedicated article on the topic of 1 euro houses in Italy.

Houses for sale in Italy

From abroad, it’s always difficult to get an idea of the Italian real estate market, which is why we advise you to contact us to receive all the necessary support when carrying out your project in Italy.

However, you can consult real estate listing websites in Italy such as casa.it, immobiliare.it, and idealista.it, which are the official sites used by Italians for property searches. We advise against dealing with private individuals through Facebook Marketplace, Bakeca.it, or Subito.it, as you could encounter dishonest individuals and lose a lot of money. Finally, being alone in a foreign country, it’s easy to fall into traps.

How to finance a property abroad?

Financing a house in Italy is not always straightforward. There are several scenarios depending on your situation.

- Applying for a mortgage in Italy is complex; banks typically lend only up to 70% of the property’s value and use it as collateral.

- Applying for a mortgage abroad for a house in Italy is nearly impossible if you don’t own any property. A foreign bank cannot use property in Italy as collateral, so they usually only grant renovation loans.

Now you’re ready to buy a vacation home in Italy!